Since the onset of the pandemic last spring, significant disruptions have impacted nearly all areas of commercial real estate (CRE). Offices in core urban locations emptied as businesses switched to work from home models. Retail and hospitality took a hit from capacity restrictions, stay-at-home orders, and temporary closures. At the same time, increased demand for online ordering and product delivery buoyed industrial and warehouse spaces.

Since the onset of the pandemic last spring, significant disruptions have impacted nearly all areas of commercial real estate (CRE). Offices in core urban locations emptied as businesses switched to work from home models. Retail and hospitality took a hit from capacity restrictions, stay-at-home orders, and temporary closures. At the same time, increased demand for online ordering and product delivery buoyed industrial and warehouse spaces.

Amid all this change, one sector showed surprising stability: multifamily housing. In particular, workforce housing remained steady, thanks to its appeal to a variety of blue and white collar professionals. This trend prevailed across Class B and Class C apartment and townhome complexes, especially in non-coastal areas.

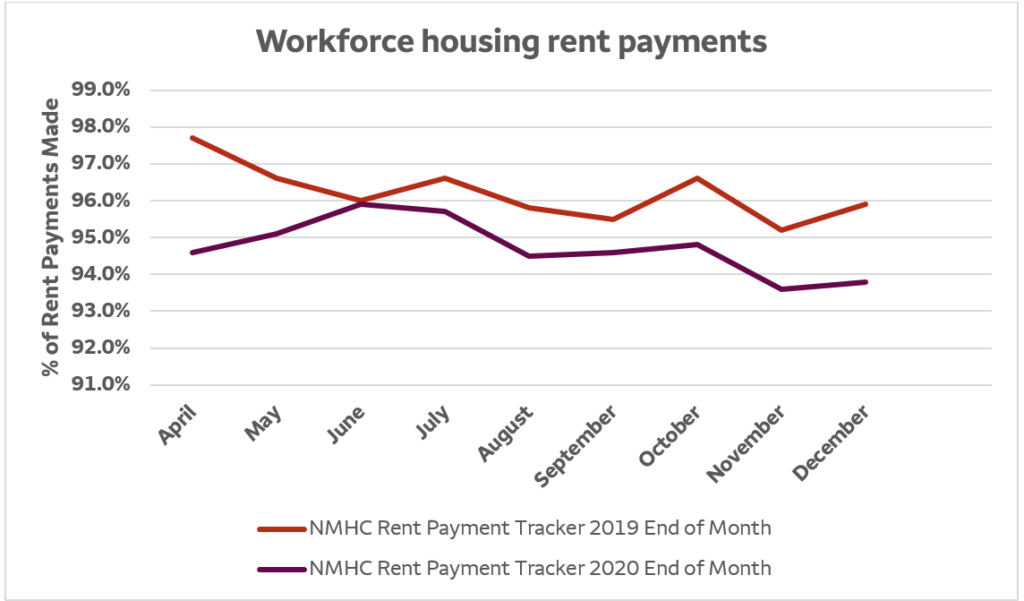

While occupancy rates, rent collection rates, and overall rental rates dipped at many amenity-laden Class A dwellings, they barely declined at mid-range properties. The latest data from the National Multifamily Housing Council (NMHC) shows that from April 2020 to February 2021, monthly rent collections in multifamily units were off only 0.1 to 3.1 percent compared to the prior year’s collections. Even when CARES Act government stimulus payments to families ended, rent collections for workforce housing barely dipped.

Consistent demand for workforce housing

Just what makes multifamily housing so resilient? A number of factors make this sector attractive to CRE investors.

High net worth individuals and family offices have always shown interest in CRE as a way to diversify their investments, particularly as an alternative to equities. Owning commercial real estate can also help investors hedge against inflation and take advantage of arbitrage opportunities.

Specific to multifamily, workforce housing has a consistent track record for high occupancy levels. Class A properties however, especially those in core urban areas, experienced declines in 2020 when businesses temporarily shuttered and the nightlife that drew crowds downtown disappeared. Class B and C properties, by contrast, showed less turnover. Two factors helped maintain this stability: their suburban location, and their appeal to occupations such as teachers, healthcare workers, manufacturing employees, and trade professionals whose work still requires a physical presence.

Suburban CRE properties also show promise. Untethered from their daily commutes, many renters are choosing to move away from population centers. Workforce housing is well positioned to accommodate their choices.

Continued confidence in multifamily’s potential

Going forward, the biggest uncertainties for investors will be the impact on workforce housing rent collections when temporary moratoriums on foreclosures and evictions expire, and when the government curtails rental assistance and stimulus payments.

However, since rent collection remained stable before, during and after personal stimulus checks, there’s confidence the sector will remain strong even as these precautions end. This spring’s American Rescue plan also extends housing support into 2021, giving property owners and tenants more time to consider their options. The latest federal stimulus includes $26 billion for rental assistance and $5 billion to assist the homeless.

As you contemplate your CRE investment options, consider these factors:

- Supply versus demand. Imbalances in local markets are one way to identify potential deals. Areas with a stable employment base, reasonable demographics, and job growth are often ripe for additional workforce housing to meet the population’s current and future needs.

- Location. The right geographic location remains crucial to success; even a few blocks can change the complexion of a neighborhood and its investment potential. Right now, inland locations show stronger prospects for multifamily properties than coastal areas or urban cores.

Wherever you target, be sure to work with local resources who know the area. Your bank can also provide insights, particularly if they cover the entire U.S.

- Arbitrage opportunities. CRE investors can often realize robust returns on properties that need a refresh. In the multifamily space, look for properties with below-market rents, deferred maintenance, and absentee owners.

- Financing options. Finally, be smart about how you structure your deal. As the leading CRE lender in the country, a bank like Wells Fargo can provide a broad range of financing options, tap the experience of experts across the company, and even support sophisticated syndication packages for large-scale projects.

There are many reasons for optimism in multifamily housing, but ultimately, the decision depends on each investor’s tolerance for risk in the current environment. It is smart to keep tabs on vaccination rates, traffic flows, and local progress toward post-COVID reopening. These and other economic markers will help you gauge when the time is right for your next multifamily investment.

May 2021